[ad_1]

- The Africa Fintech Accelerator program has elevated the variety of women-led startups

- The Accelerator program, launched in June 2023, is geared toward uplifting the digital financial system in Africa

- The listing, is majorly dominated by West and Central African states that command 11 enterprises.

Just one Kenyan fintech startup has made it via into the second cohort of Visa’s Africa Fintech Accelerator program.

Out of the attainable 20 solely CheckUps Medical Hub, an Embedded well being Kenyan startup, made it to the shortlist. Tanzania received two representatives and Ethiopia additionally received one.

The listing is majorly dominated by West and Central African states that command 11 enterprises. Whereas Southern Africa solely has three two from South Africa and one from Zambia.

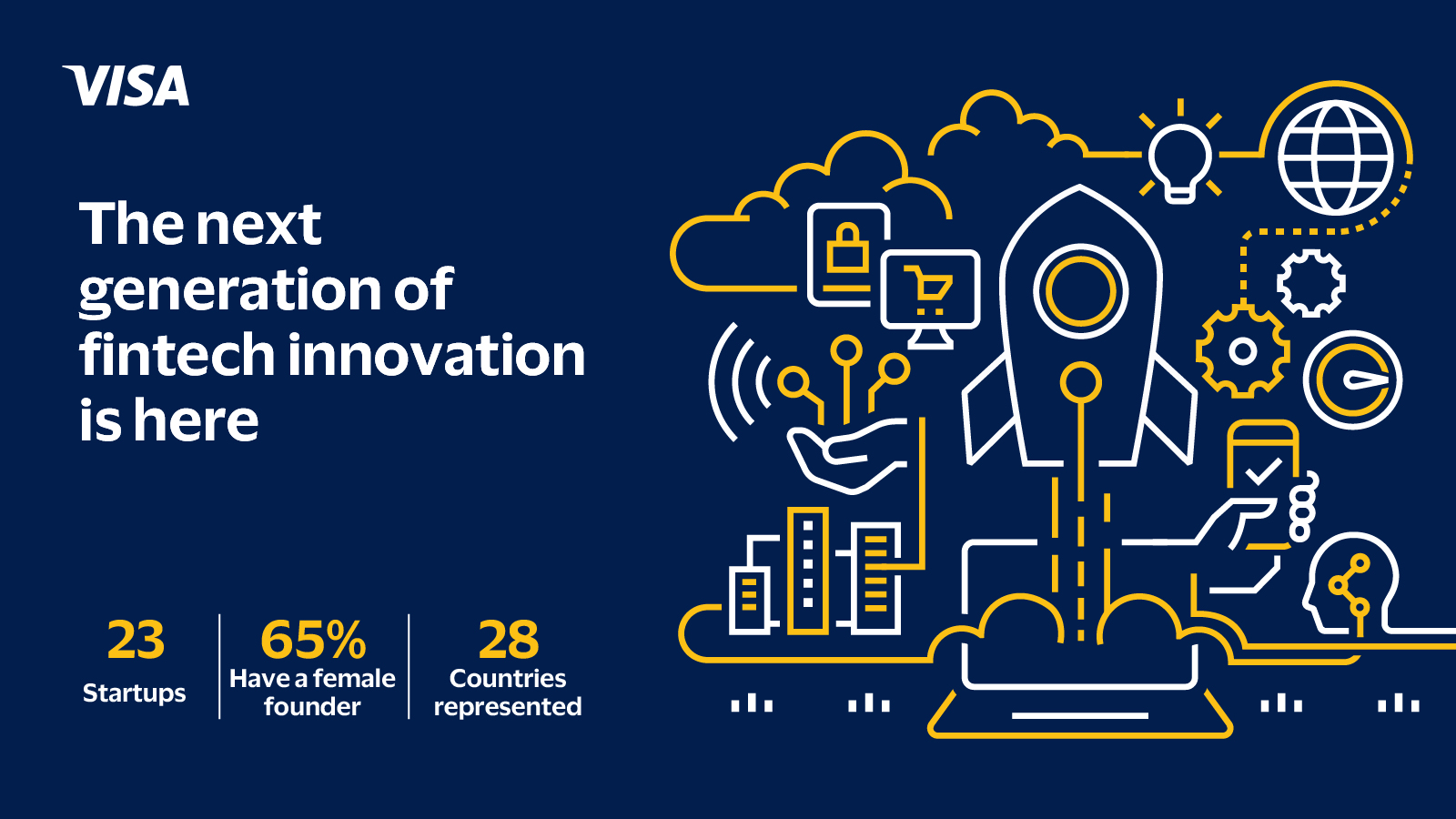

In response to the digital funds agency, Cohort 2 startups function throughout 28 African nations, a 55 per cent enhance from Cohort 1 the place the representatives operated throughout 18 nations. 65 p.c of them function feminine management, rising from 43 p.c within the inaugural version.

The chosen startups provide a spread of options, reminiscent of neo-banking, service provider funds, credit score scoring, danger and identification administration, embedded finance, social commerce, escrow providers, and extra.

They goal to handle the challenges and alternatives within the African fintech panorama, reminiscent of monetary inclusion, entry to credit score, cross-border funds, and digital transformation.

Visa Vice President, and Head of Sub-Saharan Africa Aida Diarra, stated that the second cohort additionally thought of ladies are in management roles throughout nearly all of these cutting-edge startups.

“At Visa, we consider in uplifting innovation whereas driving entry and inclusion throughout the monetary ecosystem. As we speak, we’re proud to say that our second cohort of Accelerator members represents greater than 50 per cent of nations throughout Africa, up from a 3rd throughout our first cohort,” stated Diarra.

The Accelerator program, launched in June 2023, is geared toward uplifting the digital financial system in Africa, together with a pledge to speculate $1 billion (Sh132billion) within the continent by 2027 to assist revolutionize the funds ecosystem.

The 12-week digital Accelerator program will conclude with an in-person Demo Day, the place startups may have the chance to pitch their improvements to key ecosystem gamers, funding companions, angel traders, and enterprise capitalists, enabling them to take small steps in direction of unlocking their full potential.

Africa Fintech Accelerator program nominees

This system builds on the success of the primary cohort, who graduated in February 2024 with an investor week in Nairobi that noticed the participation of greater than 250 attendees together with banking and fintech companions, traders and enterprise capital companies.

The primary cohort startups have since reported constructive outcomes from this system, reminiscent of elevated person progress, product enhancements, funding alternatives, and strategic partnerships with Visa and different trade gamers.

The Sub-Saharan Africa startups shortlisted for the second cohort of the Visa Fintech Accelerator program for Africa are:

- Chapa– Ethiopia – Service provider Options

- CheckUps Medical Hub– Kenya – Embedded Finance (Well being)

- AzamPay– Tanzania – B2B Market

- Beem– Tanzania – Social Commerce

- Bizao– Ivory Coast – Service provider Funds Resolution

- Hub2– Ivory Coast – Enabler Infrastructure

- Iwomi Applied sciences– Cameroon – Cash Motion

- Proboutik– Cameroon – Service provider Funds Resolution

- Vaultpay– Democratic Republic of Congo – Service provider Funds Resolution

- Aku– Nigeria – Neo-banking

- Cleva– Nigeria – Cash Motion

- Curacel– Nigeria – Insurance coverage Administration

- E-doc On-line– Nigeria – Open Banking

- Raenest– Nigeria – Cash Motion

- Bridgecard– Nigeria – Enabler Infrastructure

- Truzo– South Africa – Escrow Providers

As a part of Visa’s work to unlock monetary inclusion and innovation throughout the continent, the biannual program provides 12 weeks of 1:1 mentorship and personalised coaching, offering seed to sequence African startups with unique alternatives to entry funding, growth, and sources.

Brian Dempsey, Founder and CEO of Energy, a Kenyan startup that points accomplice workers entry to brief and long-term loans, funding alternatives and insurance coverage merchandise who participated within the first cohort, commented:

“The Visa Accelerator Program has been actually worthwhile for Energy as a enterprise. Every week, I’ve been capable of embrace a number of crew members on matters which are actually necessary for our rising enterprise reminiscent of HR, Finance, Governance, Go to Market Methods and so forth. The standard of the mentors and audio system has been high notch and the Accelerator crew all the time obtainable when wanted!”

African Panorama

Kenyan startups attracted $800 million (Sh127.2billion) in enterprise capital in 2023 surpassing, Egypt, Nigeria and South Africa to high the continent.

A brand new report by Africa: The Massive Deal, a platform for startup funding reveals capital injection in Kenya accounted for 28 p.c of all funds raised within the continent.

Egypt which topped in 2022 got here second with $640m(Sh101.8billion), adopted by South Africa with $600 million (Sh95.4 billion) and Nigeria $410 (Sh65.2billion).

In East Africa, Kenya’s share grew from 86 p.c in 2022 to 91 p.c in 2023, stamping its dominance in East Africa. The report reveals that startups that raised $100,000 (Sh16million) and above within the nation stood at 93.

[ad_2]