[ad_1]

- Although encouraging that the variety of feminine CEOs has risen from 230 (9.6%) in 2023 to 310 (11.1%) in 2024, these numbers present a tech phase that’s nonetheless closely dominated by males.

- Curiously, smaller ecosystems resembling Zambia, Rwanda, and Senegal are outperforming conventional hotspots like South Africa, Nigeria, Egypt, and Kenya by way of feminine management.

- Between January 2022 and June 2024, startups with feminine co-founders raised $747M, representing simply 11.9% of the overall, whereas these led by feminine CEOs secured solely $289M.

The African tech ecosystem, famend for its dynamic progress and progressive potential, is reworking. But, a urgent situation stays, gender variety inside management roles. This 12 months’s “Variety Dividend: Exploring Gender Equality within the African Tech Ecosystem” survey by Disrupt Africa highlights the gender disparities that proceed to plague this burgeoning business.

Regardless of current enhancements, the illustration of ladies in management positions inside African tech startups stays disproportionately low. The report, which additionally counts Goodwell Investments, SAIS powered by GIZ, and the Worldwide Commerce Centre’s NTF V programme amongst its companions, underscores a major gender illustration hole in African tech startups.

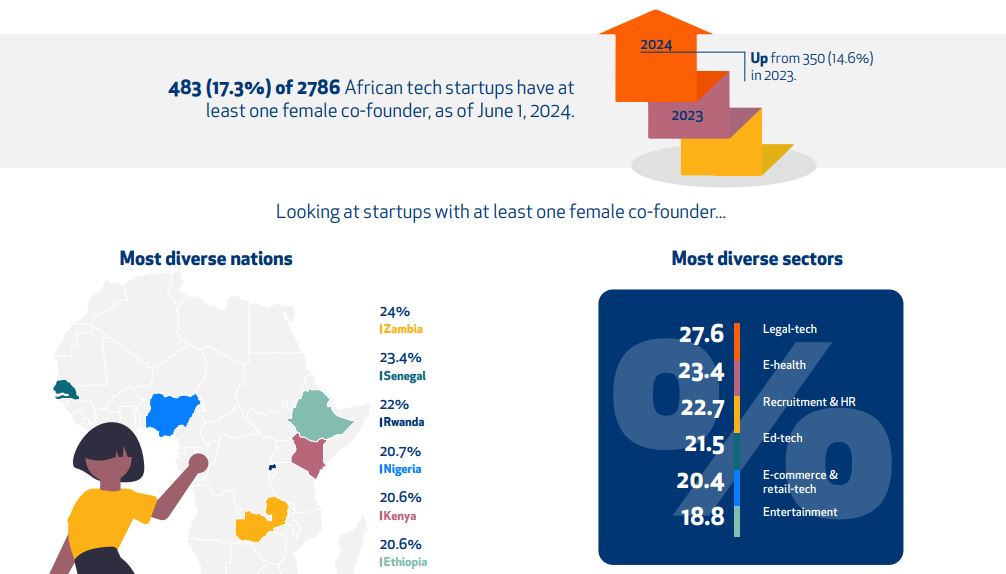

For instance, of the two,786 startups surveyed, solely 483, or 17.3 per cent had at the least one feminine co-founder. This determine, whereas nonetheless low, marks an enchancment from the earlier 12 months, the place solely 350 startups, or 14.6 per cent had feminine illustration inside their founding groups.

Equally, the variety of feminine CEOs has risen from 230 (9.6 per cent) in 2023 to 310 (11.1 per cent) in 2024. These numbers, although encouraging, reveal a tech phase that’s nonetheless closely dominated by males.

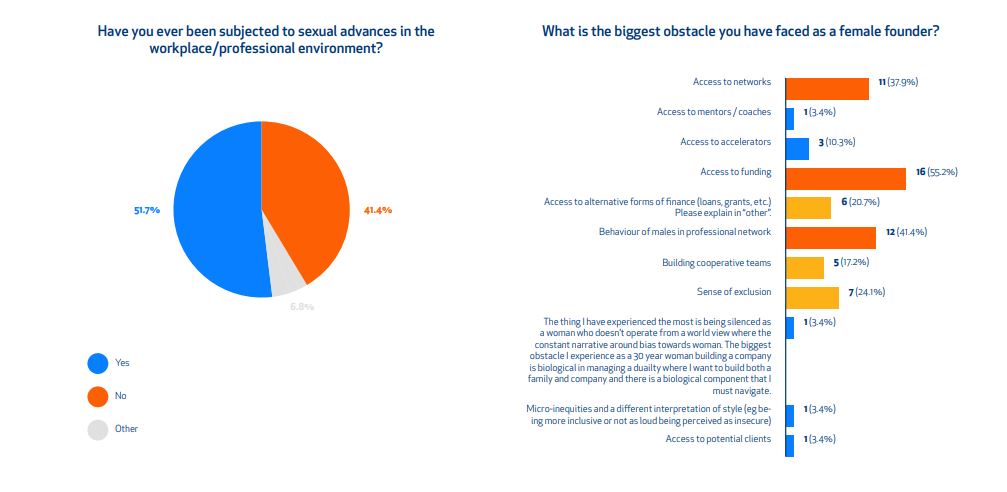

The information paints an image of gradual progress, but the strides made are inadequate to bridge the broad gender hole. The challenges that girls face in breaking into management roles inside African tech startups are manifold. From societal norms to restricted entry to sources and networks, ladies encounter quite a few obstacles that hinder their participation and success within the tech business.

Nation-specific insights: Variety in African tech startups

Gender variety in African tech startups varies considerably throughout completely different nations. Curiously, smaller ecosystems resembling Zambia, Rwanda, and Senegal outperform conventional hotspots like South Africa, Nigeria, Egypt, and Kenya by way of feminine management.

As an illustration, Nigeria noticed feminine illustration inside founding groups develop from 16.5 per cent to twenty.7 per cent, whereas the proportion of startups with feminine CEOs elevated from 10.8 per cent to 12.1 per cent. Equally, in South Africa, the proportion of startups with a feminine co-founder rose from 13.6 per cent to 18.1 per cent, and people with feminine CEOs from 8.8 per cent to 11.6 per cent.

Kenya additionally confirmed progress, with feminine illustration in founding groups rising from 16.6 per cent to twenty.6 per cent and the proportion of ventures with feminine CEOs rising from 11.2 per cent to 14.1 per cent. These enhancements, whereas noteworthy, usually are not reflective of the complete continent. In lots of different areas, the expansion in feminine management is much less pronounced, indicating a necessity for focused interventions to foster gender variety throughout the board.

Funding dynamics: The gender bias in funding

The report reveals a stark actuality within the funding dynamics of African tech startups. Between January 2022 and June 2024, an estimated 1,005 African tech startups raised a mixed $6.2 billion in funding.

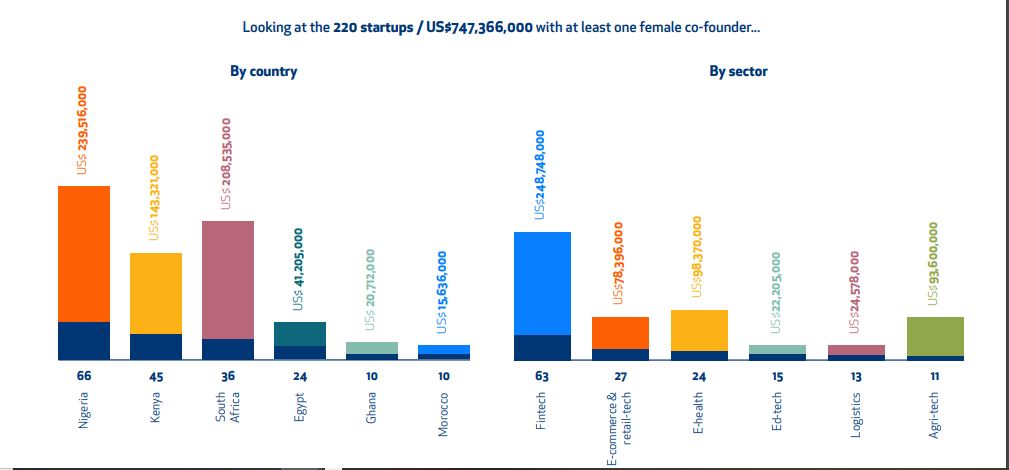

Of those, 220 accounting for 21.9 per cent had at the least one feminine co-founder, a slight enhance from 21 per cent reported in 2023. Startups with feminine CEOs accounted for 11.8 per cent of the overall, marginally up from 11.7 per cent in 2023.

Nonetheless, the disparity turns into obtrusive when analyzing the distribution of funds. Startups with feminine co-founders raised $747 million, representing simply 11.9 per cent of the overall, whereas these led by feminine CEOs secured solely $289 million, a mere 4.6 per cent of the general funding. Though these figures present enchancment from earlier years, they spotlight the persistent gender bias within the allocation of sources.

The report additionally notes a worrying pattern within the first half of 2024, the place the share of whole funding for female-led groups declined. This regression means that as general funding decreases, traders could revert to conventional patterns, favouring male-led startups.

For policymakers, this pattern underscores the necessity for aware efforts to make sure that gender variety stays a precedence even in difficult financial occasions.

Geographical and sectoral traits: Nigeria and Fintech main the way in which

With regards to geography and verticals, the report signifies that funding patterns for female-founded ventures align with broader traits. Nigeria emerges as probably the most engaging nation for funding, with 66 of the 220 startups with feminine co-founders primarily based in Africa’s most populous nation.

These Nigerian startups acquired 32 per cent of the overall funding allotted to female-founded ventures. Kenya and South Africa adopted, with 45 and 36 startups, respectively.

Fintech continues to be the main sector, accounting for 28.6 per cent of female-founded ventures and 33.3 per cent of whole capital raised. This dominance can be evident in female-led startups, with 31 out of the 119 funded corporations centered on fintech, securing 18.3 per cent of the capital.

These traits spotlight the focus of funding in particular geographies and sectors, which may probably restrict the alternatives for feminine entrepreneurs in less-established markets or rising sectors. To handle this, nations might want to deploy extra inclusive funding methods that help various geographies and industries.

The function of Enterprise Capital (VCs): A blended bag

Enterprise capital (VC) performs a vital function in shaping the African tech ecosystem. The report examined 575 VCs that invested in African startups throughout 2023 and the primary half of 2024.

Amongst these, Africa-based VCs had been probably the most energetic, with 143 companies making investments. Nonetheless, the gender variety inside these VC companies diversified broadly throughout areas.

Africa-based VCs confirmed a comparatively excessive degree of feminine management, with ladies on the helm of 44 per cent of the businesses. This determine compares favourably with the worldwide common, the place 48 per cent of companies had feminine leaders. In distinction, Center Japanese VCs had the bottom gender variety, with solely 18.2 per cent of companies led by ladies.

These findings recommend that whereas Africa is making strides in selling gender variety inside its VC ecosystem, there’s nonetheless vital room for enchancment, notably in partaking worldwide VCs to undertake extra inclusive practices. Encouragingly, European VCs, with 52 per cent feminine management, supply a mannequin of gender variety that may very well be emulated by different areas.

Learn additionally: July financing for startups in Africa hits document $420M as debt funding grows

The street forward: Making certain continued progress in gender variety

Presently, the African tech ecosystem stands at a crossroads. The progress made lately, as highlighted by the Variety Dividend report, is commendable, however it’s removed from adequate. The persistent gender disparities in management and funding should be addressed by means of concerted efforts by all stakeholders.

Policymakers, traders, and business leaders should prioritize gender variety as a key element of their methods. This might contain implementing gender quotas, offering focused funding for feminine entrepreneurs, and fostering mentorship applications that help ladies in tech.

Moreover, elevating consciousness about the advantages of gender variety, resembling improved innovation and monetary efficiency, can assist shift mindsets and create a extra inclusive ecosystem.

Furthermore, there’s a want for extra granular knowledge to know the precise obstacles confronted by ladies in numerous areas and sectors. This knowledge can inform the design of tailor-made interventions that tackle the distinctive challenges of every market.

By taking a data-driven method, the African tech ecosystem can be certain that progress in gender variety isn’t just a short-term pattern however a sustained motion towards equality.

Towards a extra inclusive African tech ecosystem

Gender variety in African tech startups is steadily enhancing, however the journey is much from over. The findings of the 2024 Variety Dividend report spotlight each the progress made and the challenges that stay. Whereas there are constructive indicators of elevated feminine illustration in management roles and entry to funding, the general image reveals a tech panorama nonetheless dominated by males.

To construct a extra inclusive African tech ecosystem, it’s important to handle the structural obstacles that restrict ladies’s participation and success. By fostering a tradition of variety and inclusion, African tech startups can unlock their full potential, driving innovation and financial progress throughout the continent. Because the business evolves, the hope is that gender variety will grow to be the norm moderately than the exception, paving the way in which for a extra equitable and affluent future.

[ad_2]