[ad_1]

- Kenya’s non-public fairness offers dimension are anticipated to stay modest this 12 months.

- Nonetheless, regardless of the excessive optimism, deal sizes in East Africa are anticipated to stay modest.

- Nonetheless, companies are involved that corporations will likely be scouting for exits, too.

Kenya and its East Africa friends are assured that the fundraising atmosphere for companies will proceed enhancing within the subsequent 12 months even because the continent experiences blended expectations.

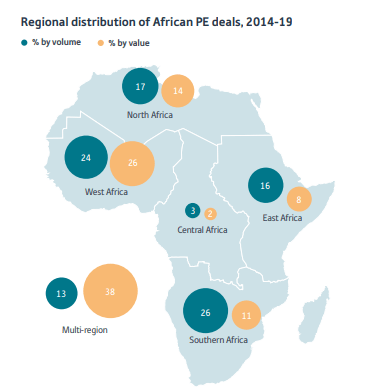

New findings by Audit agency Deloitte present that whereas East and West Africans largely anticipate an enchancment, opinions in North and Southern Africa are divided, with some anticipating enhancements, others predicting stagnation, and a few foreseeing deterioration.

This outlook comes towards the backdrop of persistent excessive rates of interest, inflation, and geopolitical uncertainty, which led to a 9 per cent drop in finalized funds year-on-year in 2023.

The Deloitte Africa Personal Fairness Confidence Survey 2024, reveals that in East Africa, optimism is on the rise, with 52 per cent of respondents anticipating the fundraising atmosphere to enhance over the following 12 months.

Considerations on Kenya’s non-public fairness offers

Nonetheless, regardless of the excessive optimism, deal sizes in East Africa are anticipated to stay modest. The survey says that 54 per cent of these polled anticipate deal sizes to be under $25 million or KSh3.2 billion, with a further 35 per cent anticipating offers between $25 million and $50 million (KSh6.4billion).

Solely 12 per cent of respondents foresee bigger offers within the vary of $50 million to $100 million, a discount from earlier years.

“The view of an improved fundraising atmosphere might be based mostly on rising Overseas Direct Funding flows into East Africa, together with from conventional markets and rising FDI flows from Asia,” the report reads partly.

Deloitte says respondents recognized governments and Growth Finance Establishments (DFIs) as their most well-liked third-party funding sources, given the longer exit timelines related to these entities.

Banks, with their substantial reserves, have additionally emerged as a key funding supply. In accordance with the survey, the give attention to small and medium-sized enterprises (SMEs) largely drives these expectations.

Wanting forward, respondents in East Africa anticipate Europe and the US to be probably the most vital sources of capital over the following 12 months, with the Center East and Asia additionally taking part in essential roles.

Africa itself, together with areas like North Africa and South Africa, can be seen as an essential fundraising supply.

China’s place as East Africa’s largest buying and selling associate and creditor beneath the Belt and Street Initiative additional underscores the significance of Asia within the area’s capital-raising efforts. Nonetheless, extra companies are additionally involved that corporations will likely be seeking to depart the market.

An estimated, 52 per cent of respondents in East Africa anticipate a rise in exit actions over the following 12 months, regardless of challenges like foreign money depreciation and inflationary pressures which have dampened non-public fairness (PE) fund returns and portfolio efficiency.

Nonetheless, 37 per cent of respondents imagine exit ranges will stay unchanged. The anticipated rise in exits is linked to the regular financial restoration post-pandemic.

Learn additionally: Kenya pushes for IPO Personal Fairness exits to shore up markets

Personal fairness corporations in East Africa

When closing store, the report discovered that personal fairness corporations in East Africa predominantly desire secondary gross sales, with 56 per cent opting to promote to different PE corporations for faster returns.

Strategic gross sales to buyers are the second most favoured possibility, chosen by 32per cent of respondents for the upper costs they sometimes command. Nonetheless, IPOs stay much less interesting as a result of considerations over low liquidity and complicated itemizing processes in East African inventory exchanges.

Regardless of restricted IPO exercise prior to now, the Kenyan authorities is actively encouraging non-public fairness corporations to contemplate the inventory market as a viable exit technique to bolster the area’s capital markets.

Learn additionally: Investing in Africa: Personal Fairness and Enterprise Capital in Africa

[ad_2]