[ad_1]

- Safaricom has requested telco trade watchdog, the Communications Authority (CA) to dam satellite tv for pc web suppliers, resembling Elon Musk’s Starlink, from working independently inside Kenya.

- Kenya’s largest telco argues that permitting satellite tv for pc suppliers to function independently may result in challenges in implementing compliance with native legal guidelines.

- Safaricom insists satellite tv for pc ISPs ought to solely be allowed to function beneath the license rights of an area firm.

A fierce battle is looming in Kenya’s web service supplier (ISP) trade, with Safaricom PLC, the area’s largest telecommunications operator, requesting the Communications Authority (CA) to dam satellite tv for pc web suppliers, resembling Elon Musk’s Starlink, from working independently throughout the nation.

This improvement units the stage for what may turn into a fierce contest over the management of Kenya’s profitable web market, as telco heavyweights Safaricom and Starlink vie for dominance in a quickly digitizing financial system.

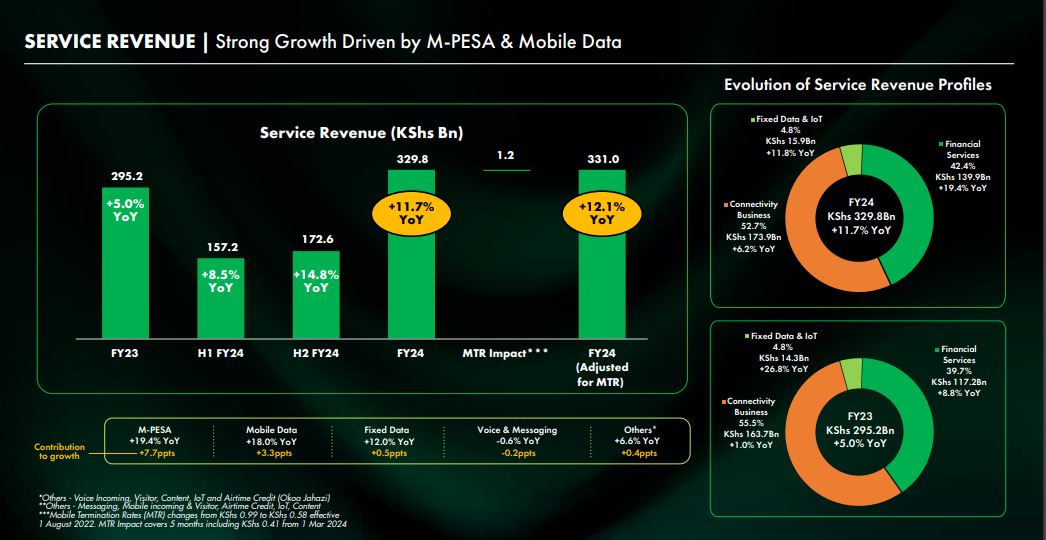

Listed on the Nairobi Securities Alternate and with annual revenues averaging $2.6 billion (KES335.4 billion) as of March 2024, telco big Safaricom offers connectivity by a variety of know-how, 2G, 3G, 4G and 5G. Since 2007, the agency has been working the world’s pioneer cellular money switch and fee platform M-PESA.

Safaricom defending market share

In the meanwhile, Safaricom’s place because the dominant participant in Kenya’s telecom trade is undisputed, boasting a 36.7 p.c market share within the information phase alone.

Within the fiscal yr ended 31 March 2024, Safaricom reported 18 per cent development in cellular information income to $490 million YoY or about KES63.24 billion within the Kenyan market.

“We proceed to leverage worth transformation, transparency, and personalised provides by CVM initiatives to reinforce affordability on our information choices. Information utilization per chargeable subscriber elevated by 6.4 per cent YoY to three.79GB whereas distinct bundle customers grew 13.8 per cent to 19.69 million. Common price per MB declined additional by 4.6 p.c YoY to six.40cents throughout the interval,” the telco reported.

“The variety of smartphones on our community grew by 12.9 p.c YoY to 22.93 million. 4G gadgets grew by 27.5 per cent YoY to 16.85 million with 49.7 per cent utilizing greater than 1GB whereas 5G gadgets rose by 79.3 per cent YoY to 669.71k. Cell information now accounts for 19.2 p.c of service income.”

Nevertheless, the emergence of satellite-based ISPs resembling Starlink threatens to disrupt this stronghold. Since its launch in Kenya in 2023, Starlink has seen speedy adoption, pushed by aggressive promotions, aggressive pricing, and the promise of high-speed web entry in even probably the most distant areas.

In a July 15 memo addressed to the CA, Safaricom made its issues clear, urging the regulator to ban satellite tv for pc service suppliers from working in Kenya with out first establishing agreements with current native licensees.

“We suggest that the CA as a substitute take into account mandating that satellite tv for pc service suppliers to solely function in Kenya topic to such suppliers establishing an settlement with an current native licensee,” the memo learn partly.

Safaricom’s argument facilities across the problem of regulating foreign-based satellite tv for pc ISPs that lack a bodily presence in Kenya. The corporate famous that permitting these suppliers to function independently may result in challenges in implementing compliance with native legal guidelines and laws, in the end undermining the federal government’s potential to supervise the trade.

Starlink difficult Kenya’s Web market establishment

Elon Musk’s Starlink, a satellite tv for pc web constellation mission developed by SpaceX with a presence in over 102 nations globally, has been quickly increasing its footprint internationally. In Kenya, Starlink’s rising enchantment lies in its potential to ship quick, dependable web to underserved areas, a state of affairs that’s resonating effectively with many customers annoyed by the constraints of the methods of conventional ISPs.

Since its launch in Kenya, Starlink has employed varied techniques to develop its person base, together with providing reductions on {hardware} and introducing a low-cost month-to-month plan at simply $10.

This aggressive pricing technique has paid off, with information from the CA exhibiting that Starlink customers grew tenfold within the three months to March 2024. In August this yr, Starlink additional disrupted the market by introducing a $15 month-to-month package rental plan, catering to customers who can’t afford the $350 {hardware} buy value.

The speedy development of Starlink’s buyer base has not gone unnoticed by native ISPs. Safaricom, specifically, has ramped up its advertising efforts in a bid to retain prospects and stave off the menace posed by the brand new entrant.

Safaricom’s issues are additional compounded by Starlink’s reliance on third-party distributors and resellers to attach customers, which Safaricom argues may result in regulatory challenges and accountability points.

On the coronary heart of Safaricom’s opposition to Starlink’s impartial operation in Kenya is the difficulty of regulatory oversight. Safaricom contends that permitting satellite tv for pc ISPs to function with no bodily presence within the nation would severely restrict the federal government’s potential to control their actions.

“Granting a license to an entity that may sometimes function in Kenya with out having a bodily presence within the nation (through third-party companions/resellers solely). This is able to imply negligible management for the federal government to make sure accountability for non-compliance points,” Safaricom said in its memo.

In response to Safaricom, satellite tv for pc ISPs ought to solely be allowed to function beneath the license rights of an area firm, making certain that they’re topic to the identical regulatory framework as different ISPs working inside Kenya.

This strategy, Safaricom argues, wouldn’t solely shield native companies, but in addition make sure that the federal government retains management over the quickly evolving web market.

Learn additionally: SpaceX provides Starlink package at half worth for first-time Kenyan prospects

Safaricom’s 5G growth: A countermeasure to Starlink?

Whereas Safaricom battles to dam Starlink’s impartial entry into the market, it’s also making strides in increasing its personal community infrastructure. On August 12, Safaricom introduced that it had crossed the 1,000 websites mark in its 5G community protection, noting that its high-speed web companies at the moment are out there in all 47 counties throughout Kenya.

This achievement marks a major milestone in Safaricom’s efforts to solidify its place because the chief in Kenya’s digital transformation.

With a complete of 1,114 5G websites overlaying 102 cities throughout the nation, Safaricom mentioned its 5G community now reaches 14 p.c of Kenya’s inhabitants of over 50 million. Moreover, the telco reported a rising variety of enterprise prospects on its 5G community, with over 11,000 companies and 780,000 lively 5G smartphones now linked.

These developments underscore Safaricom’s dedication to offering a “worry-free, always-on ubiquitous community” that bridges the digital divide and drives Kenya’s digital financial system.

Within the replace, Peter Ndegwa, CEO of Safaricom PLC, highlighted the potential of 5G to catalyze innovation and financial development, stating, “We consider that the advantages of 5G will likely be a key catalyst in leapfrogging different improvements, industries in addition to Kenya’s digital financial system.”

The street forward: Safaricom-Starlink on collision course?

As Safaricom continues to develop its 5G community and push for regulatory measures that may restrict Starlink’s operations, the battle for management of Kenya’s web market is way from over. Starlink’s potential to ship high-speed web to distant areas presents a novel problem to Safaricom’s dominance, notably in areas the place conventional infrastructure is missing.

Nevertheless, Safaricom’s entrenched place out there, coupled with its expansive 5G community, offers it a formidable benefit. The telco’s push for regulatory intervention means that it’s keenly conscious of the menace posed by Starlink and is keen to leverage its affect to guard its market share.

Within the coming months, the Communications Authority’s response to Safaricom’s proposals will likely be carefully watched by trade stakeholders. Whether or not the regulator will aspect with Safaricom or permit Starlink to function independently may have far-reaching implications for the way forward for Kenya’s web enterprise.

General, the simmering rivalry between Safaricom and Starlink is emblematic of the broader challenges dealing with conventional telecom operators as they cope with disruptive new applied sciences. As Kenya continues its journey towards digital transformation, the end result of this battle will play an important function in shaping the nation’s web marketplace for years to come back. Whether or not by regulatory intervention or market competitors, one factor is obvious: the combat for Kenya’s web market has solely simply begun.

[ad_2]