[ad_1]

- NALA raises 40 million {dollars} to gasoline worldwide growth and launch its personal fee rails for Africa and past.

- The US fintech constructing international funds for rising markets.

- $40million Collection A for NALA, the fintech that took Africa’s fee issues personally.

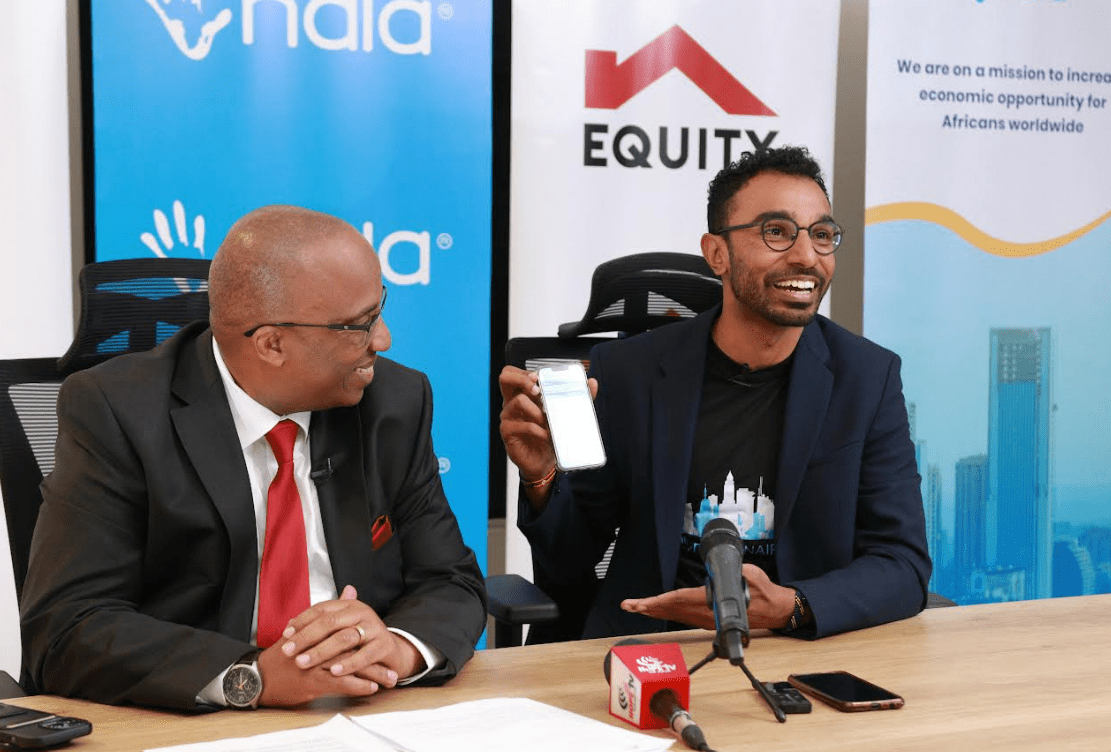

NALA raises 40 million {dollars} to construct cross-border funds for rising markets. NALA, one in every of Africa’s largest fintech corporations, has introduced the Collection funding to help its international growth and improve the reliability of funds to Africa by creating its personal fee rails.

The previous 12 months have been transformative for NALA. The corporate achieved a 10x enhance in income, reached profitability, and had optimistic money movement.

Up to now 20 months, NALA noticed a 34x enhance in transaction quantity. The NALA staff has grown from simply 7 members to a strong staff of over 100. Lastly, immediately, NALA proudly serves 500,000 prospects.

The $40 million funding spherical was led by Lauren Kolodny of Acrew Capital, who was featured in Forbes Midas checklist in each 2023 and 2024. DST International and Amplo, represented by Sheel Tyle, additionally participated.

“This $40 million funding spherical marks a pivotal second for NALA. It can allow us to transcend remittances and lengthen our attain past Africa, constructing a strong funds ecosystem,” stated Benjamin Fernandes, Founder & CEO of NALA.

Moreover, the vast majority of earlier traders elevated their stakes by taking tremendous pro-rata funding within the spherical. New traders embrace Norrsken22, HOF Capital, and notable fintech founders similar to Ryan King, co-founder of Chime, Vlad Tenev, co-founder of Robinhood, and the founding father of Klarna.

NALA raises 40 million {dollars}

The brand new funding will speed up NALA’s international ambitions, specializing in two principal areas: increasing its shopper enterprise past Africa to serve the worldwide migrant diaspora and constructing Rafiki, its new B2B funds platform.

“We’re reinvesting this cash to reinforce our infrastructure, making certain dependable, low-cost funds for all. With the launch of our personal fee rails and the growth of our B2B platform Rafiki, we’re not simply speaking about change – we’re constructing it. We’ve acquired some daring, bold plans, give us a few years,” stated Benjamin Fernandes, Founder & CEO of NALA.

Rafiki goals to put the fee rails for the subsequent billion customers, making certain reliability, managing treasury instantly, enhancing error mapping, lowering person prices, and streamlining payouts and collections.

Much like how dLocal revolutionized funds in Latin America and AirWallex remodeled the Asian market, Rafiki is about to construct a strong fee infrastructure for Africa.

That is NALA’s second spherical of fundraising in 20 months, having raised $10 million by way of Accel, Amplo, and Bessemer Companions in 2022.

Different notable angel traders embrace Jonas, the co-founder & CTO of Monzo, Robinhood founder Vlad Tenev, Laura, the co-founder of Alloy, Deel founder Alex Boaziz, and early staff at Revolut and Clever.

Africa’s fee panorama is present process a big transformation, pushed by fast technological developments and a surge in fintech innovation. With over 500 million cell cash accounts throughout the continent, Africa has develop into a world chief in cell fee options. This development is fueled by the growing penetration of smartphones and web entry, coupled with a younger, tech-savvy inhabitants.

NALA’s success story is a testomony to the continent’s burgeoning fintech sector, which is attracting substantial investments and fostering competitors.

The introduction of recent fee platforms and companies can be taking part in a vital function. Firms like Flutterwave, Paystack, and M-Pesa are revolutionising how Africans transact, enabling safe and immediate cash transfers each inside and throughout borders.

These platforms are usually not solely making funds extra accessible but in addition driving monetary inclusion by reaching the unbanked inhabitants.

Regardless of these developments, challenges stay. Regulatory hurdles, infrastructure gaps, and cybersecurity issues must be addressed to make sure sustainable development.

Nonetheless, the momentum is simple, and Africa’s fee panorama is poised for continued evolution, promising a extra linked and financially inclusive future for the continent.

[ad_2]

Supply hyperlink ⚡️