[ad_1]

- In 2024, diversification of your crypto portfolio stays a basic precept for managing threat and maximizing returns.

- Understanding the way to construct an optimum funding portfolio and monitor its effectiveness is essential for each skilled traders and newcomers.

- A well-diversified crypto portfolio sometimes contains a mixture of conventional and various belongings corresponding to shares, crypto belongings, actual property and money.

Diversification within the crypto world is not only a sensible transfer; it’s a necessity. Because the digital forex market evolves quickly, its dangers multiply. Understanding the way to construct an optimum funding portfolio and monitor its effectiveness is essential for each skilled traders and newcomers. Right here’s a information to crafting a well-balanced crypto portfolio in 2024.

Diversification within the Crypto World

In immediately’s dynamic monetary atmosphere, investing in cryptocurrencies gives engaging alternatives but in addition carries inherent dangers. Diversification, a basic idea in threat administration, performs a pivotal function in safeguarding investments in opposition to market volatility and uncertainties.

Diversification entails spreading investments throughout varied asset lessons to scale back total threat publicity. The essence lies within the age-old adage: “Don’t put all of your eggs in a single basket.” By allocating funds throughout totally different asset lessons and cryptocurrencies, traders can decrease the impression of hostile market actions on their portfolios.

Primary Ideas

Diversification isn’t merely about spreading investments; it’s additionally about choosing belongings with low correlations to one another. This ensures that if one asset underperforms, others could compensate, sustaining portfolio stability.

The Environment friendly Frontier mannequin and metrics just like the Sharpe ratio and Beta coefficient assist traders optimize risk-adjusted returns. Attaining a steadiness between threat and return is essential when developing a diversified portfolio.

Examples of Diversification

A well-diversified crypto portfolio sometimes contains a mixture of conventional and various belongings:

- 30% Shares

- 30% Crypto Belongings

- 30% Actual Property

- 10% Money

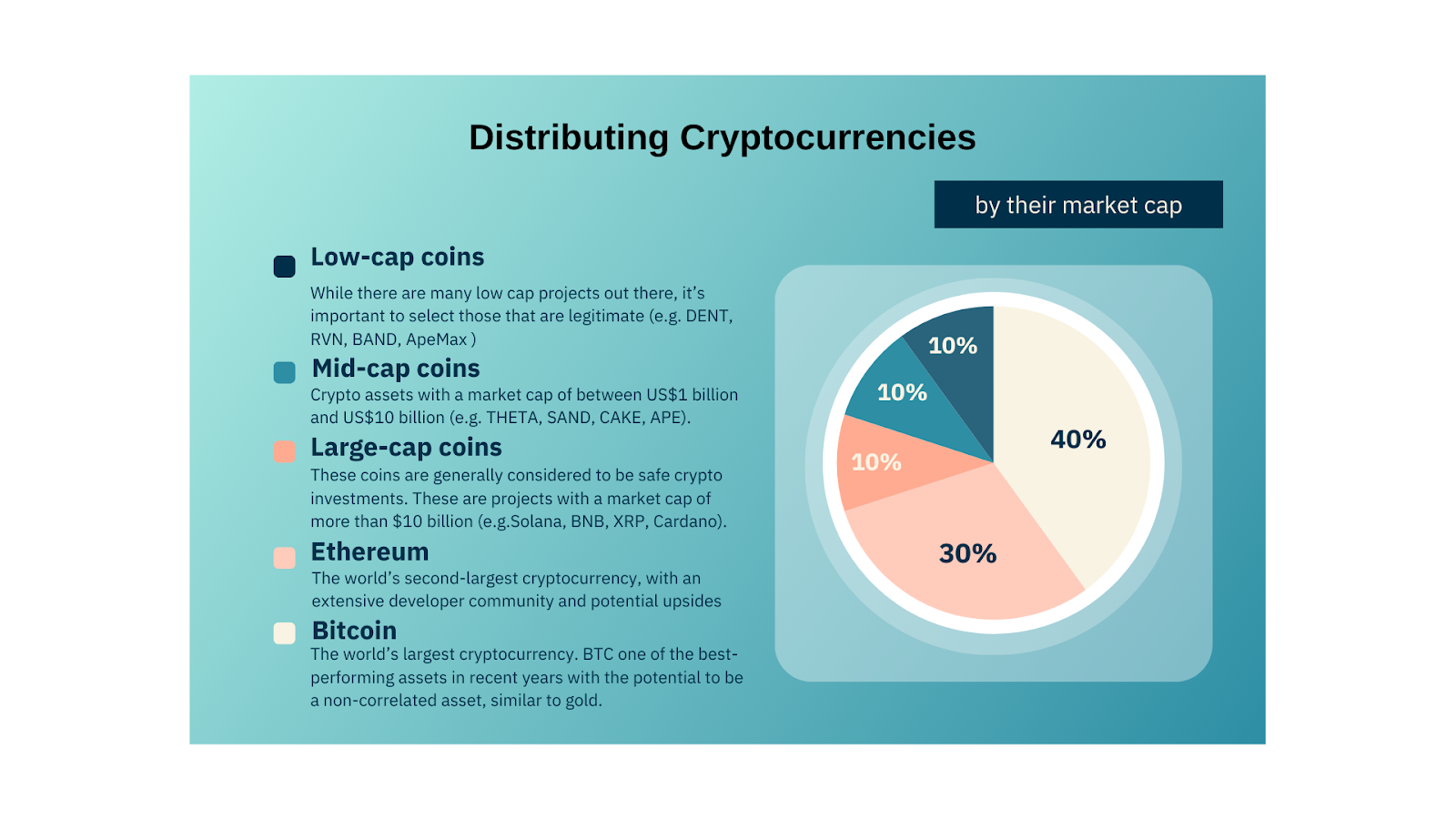

Inside the crypto allocation, additional diversification will be achieved by distributing investments throughout totally different market capitalizations:

- 40% Bitcoin

- 30% Ethereum

- 10% Massive-cap cryptos (e.g., Solana, BNB, XRP, Cardano)

- 10% Mid-cap cryptos (e.g., THETA, SAND, CAKE, APE)

- 10% Low-cap cryptos (e.g., DENT, RVN, BAND, ApeMax)

By diversifying throughout sectors like DeFi, Web3, and NFTs, traders achieve publicity to various alternatives throughout the crypto ecosystem.

Why Diversification Issues

Diversification gives a number of advantages:

- Lowering portfolio volatility

- Facilitating rebalancing

- Increasing information of finance and fintech

Whereas diversification could doubtlessly yield decrease returns in comparison with high-risk speculative investments, it gives stability and resilience in risky markets.

Extra Concerns

Past asset diversification, traders should diversify their alternate utilization, particularly contemplating current occasions within the crypto area. Using a mixture of centralized and decentralized exchanges is advisable, with a give attention to safety and transparency. An rising idea, CeDeFi (Centralized-Decentralized Finance), goals to mix one of the best of each fashions and combine Proof-Of-Reserves techniques for added safety.

Selecting Digital Belongings Properly

When choosing digital belongings, think about correlation ranges between totally different cryptocurrencies. Low correlations between ADA vs XRP, for instance, counsel that their costs transfer independently, making them supreme candidates for inclusion in the identical portfolio.

Moreover, paying heed to crypto value predictions and market developments can inform funding choices. That is very true for cash with low market capitalization, that are extraordinarily dangerous belongings. Due to this fact, earlier than investing in one thing like Dent, studying DENT value predictions from main crypto analysts is a should.

Wrapping up on crypto portfolio diversification

In 2024, diversification stays a basic precept for managing threat and maximizing returns within the dynamic world of digital forex. Whereas there’s no one-size-fits-all method, understanding the fundamentals, staying knowledgeable, and embracing progressive options will help navigate the complexities of the crypto market with confidence and prudence. Keep in mind, make investments correctly and inside your means.

Learn additionally: Cryptocurrency investments: utilizing exchanges to develop your capital

[ad_2]