[ad_1]

- Savannah Clinker seeks to amass 100% of the Nairobi Securities Change-issued shares of Bamburi Cement for $197.3M (KES25.4Bn), a proposal that’s larger than the $180M (KES23Bn) positioned earlier by Amsons Group.

- The competitors between Savannah Clinker and Amsons Group underscores an ever-persistent rivalry between Kenyan and Tanzanian companies within the East African market.

- In July, Amsons’ $180M provide was seen as a strategic transfer to develop its footprint in Kenya and faucet into the profitable development market.

The push by Tanzania-based conglomerate Amsons Group to develop its footprint throughout Kenya by way of the acquisition of Bamburi Cement has taken a recent twist after a Kenyan-based mining agency Savannah Clinker Ltd positioned a extra enticing counter-offer for the total acquisition of Bamburi PLC.

Within the newest submitting with market regulators, Savannah Clinker seeks to amass 100 per cent of the Nairobi Securities Change-issued shares of Bamburi Cement for $197.3 million(KES25.4 billion), a proposal that’s larger than the $180 million or KES23 billion positioned in July 2024 by Amsons Group.

Savannah Clinker’s provide not solely surpasses the preliminary bid by cement producer Amsons Group, but additionally highlights the strategic significance of Bamburi Cement as a key participant within the area’s development sector in addition to business.

“I’m happy to current this competing provide, which represents a patriotic dedication to safe Kenyan manufacturing pursuits, now that a possibility to exit a significant multinational participant is on the desk,” stated Savannah Clinker Government Chairman and Director Benson Ndeta in a press release.

He added, “I’ve been concerned within the native [Kenyan] enterprise and development industrial sector for the final twenty years. I’ve served as a former non-executive chairperson on the East African Portland Cement and a former majority shareholder at Savannah Cement till November 2022. I’m subsequently dedicated to investing within the development of Bamburi Cement by way of this acquisition bid and a fair bigger capital expenditure outlay to speed up modernization and working effectivity programmes.”

Rivalry between Kenyan and Tanzanian companies

The competitors between Savannah Clinker and Amsons Group underscores an ever-persistent rivalry between Kenyan and Tanzanian companies within the East African market. Bamburi Cement, one of many largest cement producers within the area, is a precious asset for any firm trying to solidify its place within the mining, constructing, and development business.

Amsons Group, a Tanzanian conglomerate with various pursuits, had initially gave the impression to be the frontrunner within the race to amass Bamburi PLC, which exited Uganda market late final 12 months. Their $180 million provide was seen as a strategic transfer to develop their footprint in Kenya and faucet into the profitable development market. Nevertheless, Savannah Clinker’s counter-offer not solely challenges Amsons’ place but additionally introduces a nationalist ingredient to the bidding conflict, with Ndeta framing his bid as a transfer to maintain Bamburi Cement firmly underneath the management of Kenyan palms.

Monetary and strategic implications

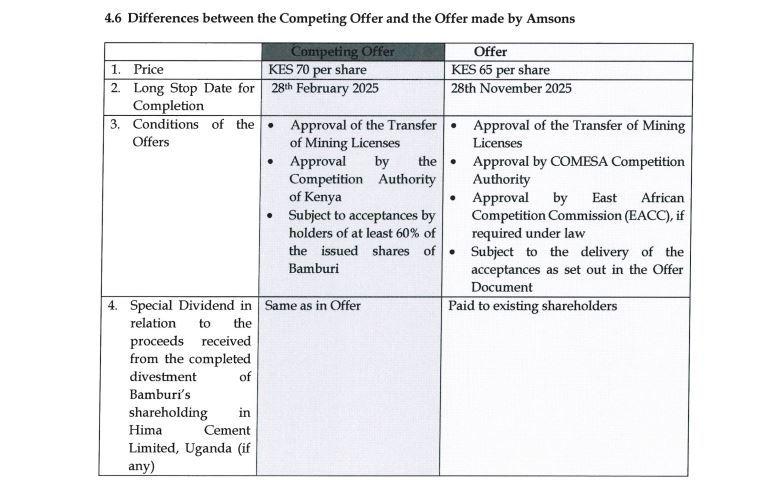

Savannah Clinker’s provide of $0.54 (KES70) per share represents a 53.34 % premium over the share value as of July 9, 2024, and a 64.55 % premium over the 30-day volume-weighted common value (VWAP), the Kenyan firm defined in a market replace. This premium is a transparent pointer to Ndeta’s dedication to securing Bamburi Cement and is more likely to attraction to shareholders looking for fast returns.

Along with the monetary incentives, Savannah Clinker’s bid presents a number of strategic benefits. By buying Bamburi Cement, Savannah Clinker would achieve management of a significant participant within the East African cement market, with appreciable manufacturing capability, a well-established model and market share, too. Topic to regulatory approvals, the acquisition would additionally permit Savannah Clinker to develop its operations and improve its market share, positioning it as a dominant drive within the regional development business.

Furthermore, Savannah Clinker’s dedication to retaining as much as 40 % of Bamburi’s shares as free float on the Nairobi Securities Change (NSE) displays a need to take care of transparency and proceed partaking with institutional and native traders. This strategy contrasts with Amsons Group’s provide, which has been criticized for probably resulting in the delisting of Bamburi from the Nairobi bourse.

Regulatory and market reactions

The Capital Markets Authority (CMA) and different regulatory our bodies will play a vital function within the final result of this bidding conflict. Each Savannah Clinker and Amsons Group might want to navigate a fancy regulatory area to safe approval for his or her respective presents.

Savannah Clinker’s dedication to finishing the transaction by February 28, 2025, offers a further benefit over Amsons Group, which has set an extended timeline with an extended cease date of November 28, 2025. This accelerated timeline might show enticing to shareholders desirous to money in on their investments sooner quite than later.

Market reactions to Savannah Clinker’s counter-offer have been largely optimistic, with analysts noting the strategic significance of maintaining Bamburi Cement underneath Kenyan possession. The provide has additionally sparked renewed curiosity in Bamburi’s shares, with costs anticipated to rise because the bidding conflict intensifies.

Learn additionally: Tanzania’s Taifa fuel to shake-up Kenya’s cooking fuel market

Implications for the East African cement market

The result of this bidding conflict will have an effect on the East African cement market. If profitable, Savannah Clinker’s acquisition of Bamburi Cement would strengthen Kenya’s place within the regional development business and probably result in elevated competitors between Kenyan and Tanzanian companies.

Alternatively, if Amsons Group had been to prevail, it might mark a shift within the stability of energy within the East African market, with Tanzanian companies gaining a stronger foothold in Kenya. This might result in elevated competitors and probably decrease costs for customers, but it surely might additionally increase issues about international possession of key industries in Kenya.

Because the bidding conflict between Savannah Clinker and Amsons Group continues to unfold, the way forward for Bamburi Cement hangs within the stability. Shareholders might want to fastidiously take into account the monetary and strategic implications of every provide earlier than making their choice.

For Savannah Clinker, the trail ahead includes not solely securing the required regulatory approvals but additionally profitable over shareholders and convincing them that their provide is in one of the best long-term pursuits of the corporate. The agency’s dedication to retaining Bamburi’s Kenyan id and investing in its future might show to be a decisive issue on this high-stakes battle.

Because the deadline for ultimate presents approaches, all eyes shall be on the East African cement market, the place the rivalry between Kenyan and Tanzanian companies is ready to form the way forward for the area’s development business. Whether or not Bamburi Cement stays underneath Kenyan possession or turns into a part of a Tanzanian conglomerate, the end result of this bidding conflict could have lasting repercussions for each international locations and the broader East African market.

[ad_2]